I spent 15 years teaching personal finance in high school while consulting for Departments of Education and organizations such as NGPF. After leaving teaching and moving to Atlanta to support my wife, I transitioned to a full-time position with NGPF. Then, I took a one-year term position as a Visiting Scholar with the Consumer Financial Protection Bureau.

I'm sharing this as background to give you a glimpse of how important youth financial education is to me.

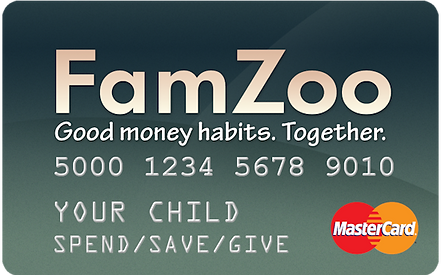

We are a FamZoo family. We used FamZoo when our kids were younger and loved it. The digital platform was the ideal support tool for financial education and management with our kids.

Why FamZoo?

We used FamZoo while I was working 60-80 hours a week. My wife used it just as much as I did, maybe more. We recently took a trip down memory lane to discuss how we used it and what we loved about it.

My wife, Hope, the mother of our three kids, recalls the chaos of managing allowances and tracking expenses before FamZoo entered their lives. "It was overwhelming," she says, "I felt like I was constantly juggling spreadsheets and cash, trying to keep up with who earned what and where it was being spent."

FamZoo, with its intuitive interface and versatile features, offered a solution that resonated with the entire family. What's great about FamZoo is how it combines financial management with valuable lessons for the kids. It's not just about managing money but teaching responsible habits.

Teaching Financial Literacy

One of the standout features of FamZoo is its emphasis on financial literacy. It provides a practical platform for kids to learn about budgeting, saving, and investing.

Our kids were learning money skills without realizing it. The customizable "accounts" feature allowed us to simulate real-life scenarios. They could allocate money for spending, saving, and giving, learning to make informed choices.

Empowering Financial Independence

As the children grew older, FamZoo evolved with them. The cards made it easy for them to understand that cashless transactions were real. And using the cards led to natural conversations that led to financial literacy lessons with my children.

We learn best by experience. Children learn best by experience. Learning opportunities can be created artificially, like in a classroom. However, they best occur in an environment that naturally unfolds. FamZoo cards empowered us to provide financial literacy lessons more frequently.

We learn best by experience. Children learn best by experience. Learning opportunities can be created artificially, like in a classroom. However, they best occur in an environment that naturally unfolds. FamZoo cards empowered us to provide financial literacy lessons more frequently.

Brian Page, Founder of Modern Husbands

Pictured is his middle child, Bryce

About Our Partnerships

You are ALWAYS our first priority.

We share winning ideas to manage money and the home as a team. We have partnered with companies we believe allow Modern Husbands to do both with excellence and efficiency, while living the lifestyle of a modern husband. In many cases, the Modern Husbands Founder uses the products or services himself.

We’re proud that the guidance we offer. The information we provide and the resources we create are objective, independent, straightforward, and evidence-based.

So how do we make money? Our partners compensate us, but we selected them to review and write about, which in no way affects our recommendations or advice. And our partners cannot pay us to guarantee favorable reviews of their products or services. We are highly selective in the partners we choose. Our first priority is you.