Table of Contents

Overview

It is expensive to raise a child. A middle class family with two children and two parents will spend about $310,605 between the day their baby is born and the day they turn 18, according to a Brookings Institution analysis of data from the Agriculture Department. This does not include the cost of college.

This is a post about the cost of raising children, not the incredible rollercoaster of emotions, much of which is joy, that parents experience raising children. I won't entertain the argument, "but I love all of my children and have no regrets."

I have three, and I love them and do not regret having them. I'd say the same if I had six, but this isn't a post that measures the love for our children; it measures the cost of them.

No single expense is more significant and unpredictable for most American families than children. The more children you have, the more unpredictable the cost.

A past report found that 54% of expectant parents dramatically underestimate their baby's first year of life. It’s human nature to dream of a rosy price tag of something we want, assuming everyone else’s estimates are wrong because we are just smarter and more frugal.

Sure, money can be saved purchasing thrift shop toys and second hand clothing. Maybe the kids share a room and you never feel the need to grow the size of your home with the size of your family. But there are limits.

You can’t control the cost of healthcare and unpredictable medical expenses, costs and risks that grow exponentially with each child you have. You can’t help the cost of auto insurance when the first born hits driving age and the youngest has graduated college or is entirely independent.

Perhaps you can save by not eating out and buying cheap groceries, but the cost is what it does to our body, consequences later felt by paying more for medical expenses. Keep in mind the time it takes to only eat at home, meal preparation, clean up, grocery shopping, etc. Much of parenthood is balancing limited money with limited time.

Children are equally, if not more demanding on time. How much time parents spend with children doesn’t change much, what changes is how and where the time is spent.

Before any big expense we tell ourselves,

“I’ll figure it out.”

For your own well-being, “figure it out” before you have children, not after, which is precisely the purpose of this post.

The Toughest Predicament for Parents

Private school or public school? Activities, enrichment programs; the opportunities for children are limitless, but the cost is limited for parents.

How can parents know what is "enough" for their kids?

This question was the most stressful for me to find an answer to as a parent myself.

I posed this question to Ron Lieber. Ron Lieber is the author of the best-selling book The Opposite of Spoiled: Raising Kids Who Are Grounded, Generous, and Smart About Money. Ron has been the "Your Money" columnist for The New York Times since 2008.

Ron's response is profound.

Ron Lieber is one of 50+ national experts who contributed to our Transition to Marriage Toolkit. The afore-shown response was one of three recorded for the toolkit.

Budgeting Calculators

Estimate Costs using EPI's Family Budget Calculator

The EPI Family Budget Calculator measures the income a family needs in order to attain a modest yet adequate standard of living. This is a tool to provide users with the perspective of cost, not to build a custom budget for themselves.

What I love about this calculator is that expected costs can be:

Estimated based on the area of the country

Estimated based on the size of the family (including number of children)

Everything can be compared side by side (click add comparison)

Click here to access the calculator.

Cost of Raising a Child Calculator

The Washington Post used data from “Expenditures on Children by Families” published by the U.S. Agriculture Department from the 1990s through 2017 to determine the costs used in the calculator. The reports summarize spending detailed in the Consumer Expenditure Survey.

Click here to access the calculator (there might be a paywall).

Related: Take our free marriage readiness quizzes.

A Breakdown of Child-Raising Costs

Based on this USDA report, here’s a breakdown of what people are spending money on to raise their kids. (Note – costs have risen significantly due to a spike in inflation four years after the report was released)

Housing: 29%

Food: 18%

Transportation expenses: 15%

Healthcare: 9%

Education: 16%

Other: 7%

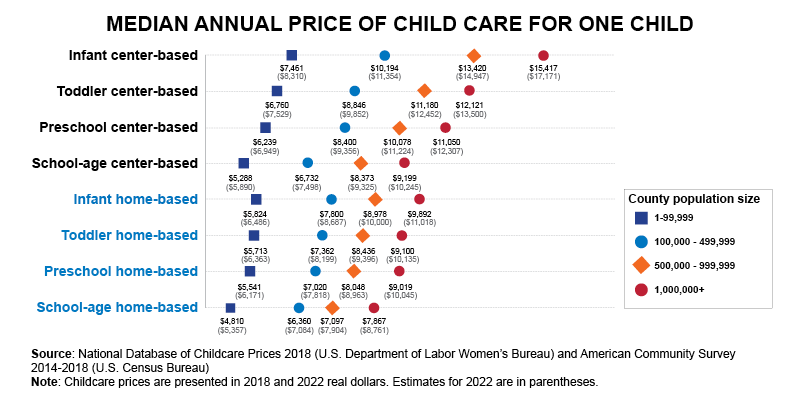

Childcare Prices

The National Database of Childcare Prices (NDCP) controlled by the U.S. Department of Labor is the most comprehensive federal source of childcare prices at the county level.

Averages

Cost of Child Care Based on Type of Care

Click here to use the interactive calculator.

Cost of Child Care Based on Location

Click here to use the interactive calculator.

Additional Costs

It's hard to predict exactly where the most significant costs of raising your children will come from. Take, for instance, budgeting for sports. The average family pays $883 annually for one child's primary sport. This assumes that the child is not a high-level select athlete. This same data point found the average registration was $168.

For perspective, our middle child plays high school soccer. The registration fee for the high school team is $475. The registration fee for his select team is around $2,000. Uniforms and cleats run between $500-$750 annually, travel costs two years ago were around $1,500, and a recruiting event was around $700. That's one child for one sport: $5,500-$6,000 annually. And for his competitive level, this is a bargain.

Examples such as this range in all types of ways: enrichment clubs, camps, and art programs. The list is never-ending. You might believe you would refuse to incur this cost if you don't have older children. Still, you need to be more realistic with the inherent obligation to provide your child with the opportunities to shine at what they are passionate and talented in doing. Don't underestimate the fear your child will resent you for holding them back or the joy you will experience watching them smile and shine.

Transition to Marriage Toolkit

This post is a glimpse into what to expect if you purchase the Transition to Marriage Toolkit. The backgrounds of the 50+ national content experts who contributed to the Toolkit are below:

Designed for engaged and recently married couples, it is the ideal resource for those who want to manage money and the home as a team.